The Threat of Inflation to Ghana: An Analysis of Monetary Policy and Economic Growth

15 Feb, 2025

Ui/Ux Design

Rising Inflation and Money Supply Growth

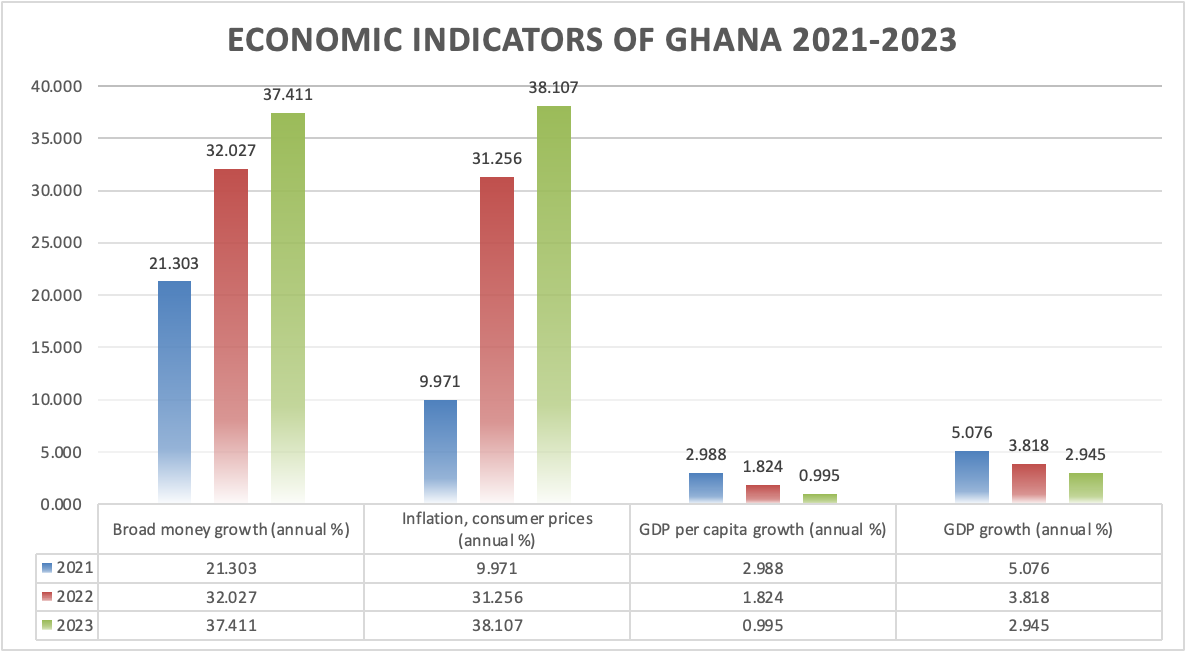

According to the World Development Indicators, Ghana’s broad money supply grew from 21.3% in 2021 to an alarming 37.4% by 2023. This increase in money supply correlates strongly with the rise in inflation, which surged from 9.9% in 2021 to a staggering 38.1% by 2023. This rapid expansion in the money supply can be understood through the Quantity Theory of Money, which posits that inflation occurs when the amount of money in circulation grows faster than the economy’s capacity to produce goods and services. For instance, the Bank of Ghana data shows that nominal GDP growth has not kept pace with the increase in the money supply. In 2022, real GDP grew by only 3.8%, while inflation remained above 35%. This mismatch between money growth and economic output fuels inflation, as there is more money chasing the same amount of goods, leading to price hikes across sectors, especially in food prices, which inflated by 54.2% in mid-2023.

Government Spending and Borrowing

A significant driver of the inflationary pressures in Ghana is government overspending. According to the Bank of Ghana, total government expenditure in early 2024 reached 19.2% of GDP, while revenue generation lagged at just 16.0%. This budget deficit forces the government to rely heavily on borrowing, both domestically and internationally. Ghana’s public debt has now reached 72.6% of GDP by 2024, leading to higher interest payments and reduced fiscal space. When governments spend beyond their means, they often resort to borrowing or printing money to cover the deficit. In Ghana’s case, the rapid expansion of the money supply suggests the government has relied heavily on increasing the money supply to cover its expenditures. However, printing more money without a corresponding increase in production results in inflation, which is essentially a tax on the public. Citizens purchasing power erodes, and while nominal wages may remain stagnant, prices for basic goods like food, fuel, and housing skyrocket.

Taxation and the Middle Class Burden

The high inflation environment disproportionately affects the working class and middle-income earners. Inflation erodes the purchasing power of wages, meaning that Ghanaians now need more cedi to buy the same basket of goods. This is particularly dangerous for the middle class, as rising food prices (which accounted for inflation rates of over 50% in 2023 consume a larger share of household incomes. At the same time, the government has raised taxes to manage its debt burden and stabilize its fiscal position. However, increasing taxes in an already inflationary environment creates a double burden on citizens: not only do they face rising prices, but they also have less disposable income due to higher taxes. As a result, there is a real risk that inflation will reduce consumption, slow down economic activity, and hinder long-term growth prospects.

Monetary Policy and Economic Growth

In response to these inflationary pressures, the Bank of Ghana has tightened monetary policy by raising the monetary policy rate to 29% in early 2024. While this is intended to curb inflation by making borrowing more expensive and reducing money circulation, it comes at the cost of economic growth. High interest rates discourage businesses from borrowing to invest in expansion, limiting job creation and overall productivity growth. Additionally, high inflation and a depreciating currency (the Ghanaian cedi depreciated by over 14% against the dollar in early 2024 reduce investor confidence, further constraining growth. While the intention behind raising interest rates is to control inflation, Ghana finds itself in a precarious situation where tight monetary policy could worsen economic stagnation.

(World Bank. 2024) Authors Computation

The effects of inflation are being felt across every segment of society. Businesses are struggling with rising input costs, particularly in industries like agriculture, where the cost of imported seeds, fertilizers, and machinery has skyrocketed due to the weakening cedi. At the consumer level, basic goods such as bread and cooking oil have become prohibitively expensive, contributing to social unrest and increasing poverty rates. Inflation in Ghana has also worsened income inequality. While the wealthy, who have significant investments in real estate and foreign assets, can hedge against inflation, the middle and lower-income segments of the population bear the brunt of the crisis. As inflation pushes prices up, the purchasing power of the average Ghanaian worker continues to decline.

The Perilous Path Ahead for Ghana's Economy

Ghana stands at a critical crossroads where the convergence of rampant inflation, government overspending,

and misguided monetary policies threatens to unravel decades of economic progress. The alarming surge in

inflation to 38.1% by 2023 is not just a statistical anomaly but a stark indicator of deeper structural

issues. The government's reliance on expanding the money supply to cover deficits, coupled with excessive

borrowing that has ballooned public debt to 72.6% of GDP, is unsustainable. These actions have set off an

inflationary spiral that erodes the purchasing power of citizens, widens income inequality, and stifles

economic growth.

The danger of this trend cannot be overstated. If left unchecked, Ghana risks plunging into a severe

economic crisis marked by hyperinflation, a depreciating currency, and loss of investor confidence. The

middle class, often the backbone of economic resilience, is being squeezed from both ends—facing

skyrocketing prices for basic necessities while shouldering higher tax burdens. This not only dampens

consumer spending but also hampers business investment, leading to job losses and heightened social unrest.

Moreover, the current trajectory undermines Ghana's long-term development goals. High interest rates

intended to curb inflation are simultaneously choking the very economic activities needed for growth and

recovery. The depreciating cedi amplifies external vulnerabilities, making imports more expensive and

fueling further inflation. In a global economy still reeling from post-pandemic challenges and grappling

with the aftermath of recent conflicts, Ghana cannot afford to ignore the warning signs flashing across its

economic dashboard.

Immediate and decisive action is imperative. This includes implementing prudent fiscal policies to rein in

government spending, restructuring debt obligations, and adopting monetary measures that balance inflation

control with the need for economic vitality. Failure to address these issues head-on could consign Ghana to

a prolonged period of economic hardship, reversing the gains made in poverty reduction and human

development.

The stakes are high, and the window for corrective action is narrowing. Ghana must confront the hard truths

of its economic situation and make difficult choices to steer the nation away from the precipice. The cost

of inaction is simply too great—a future where economic instability becomes the norm, opportunities dwindle,

and the aspirations of millions are left unfulfilled. The time to act is now, before the threat of inflation

becomes an irreversible reality.

REFERENCES

https://www.bog.gov.gh/wp-content/uploads/2024/05/Summary-of-EconomicFinancial-Data-May-2024.pdf

World Bank. 2024. World Development Indicators. Retrieved September 19, 2024, from https://data.worldbank.org/indicator